"Nick Has an Exocet" (nickallain)

"Nick Has an Exocet" (nickallain)

02/28/2018 at 21:55 ē Filed to: citibank, zelle, popmoney, credit unions

0

0

8

8

"Nick Has an Exocet" (nickallain)

"Nick Has an Exocet" (nickallain)

02/28/2018 at 21:55 ē Filed to: citibank, zelle, popmoney, credit unions |  0 0

|  8 8 |

I have had it with Citibank and need to switch where my money is. Why? Iím glad you asked... So far, Iíve called Citibank customer support more than 15 days this month.

Warning: This is mostly me just bitching about Citibank. Citibank wanted me to review their services so badly that they went and made transferring money require some kind of act of God.

My rent was due on February 1st. The same day (apparently) that Citibank decided that it was out with Popmoney and in with Zelle. Thatís great, since I used Popmoney to reliably transfer my rent to my landlord. I convinced the landlord to sign up for Zelle. Unfortunately, I was also traveling in Europe until the 4th of this month and didnít have the ability to get the confirmation texts required to send the payments through the new fangled system. They graciously said ďno problem, just send when you get backĒ. On the 4th, I sent the payments (split in two), and they went to ďpendingĒ while the landlord set up their account.

But their account took Zelle 14 days to process. During that time, ďpendingĒ went to ďexpiredĒ. Sigh. I guess Iíll just send it again. Wrong. †

By this point, I was back in Europe. The website again required texting/calling me a code. Thankfully, there is a backup number that you can call to get the code but itís only open during american hours. No worries, Iíll just do that after work in the evening. I set up the payment, hit ďsendĒ, get the number to get the code over the phone, call it, then spend 20 minutes on old, 15 minutes giving my family history to a stranger, then I get transferred to a number that gives me a code. I type it in and....

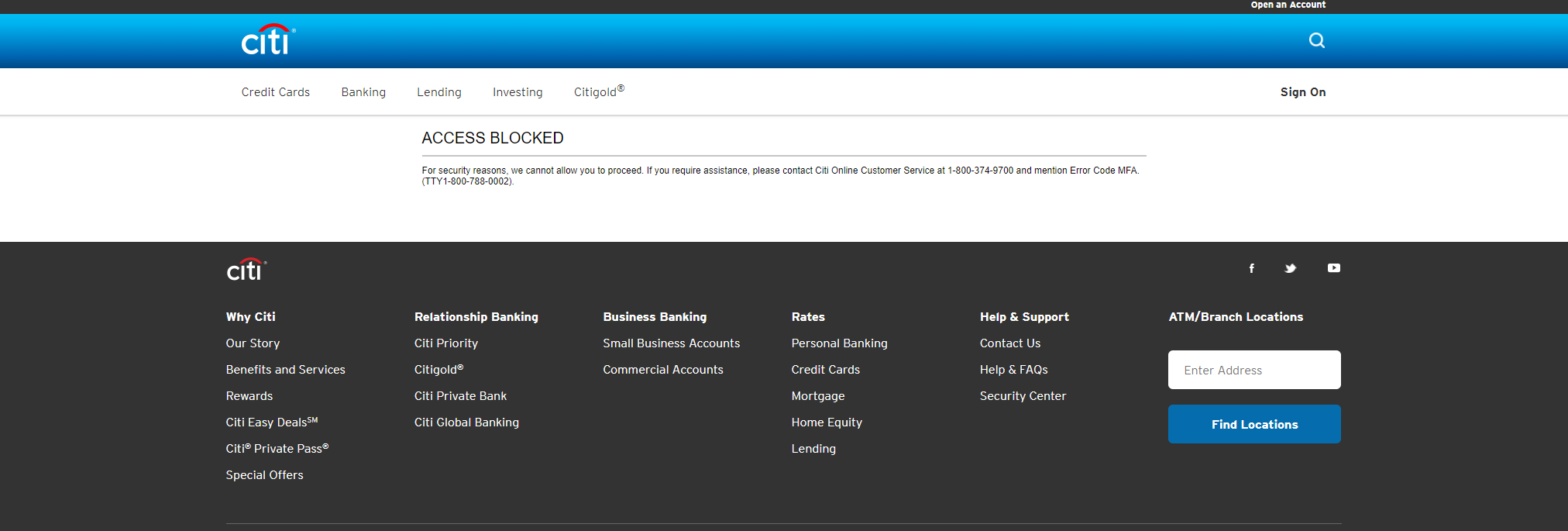

This is my favorite error message. Itís basically the epitome of trying to send money with Zelleís Citibank integration. You get this if you type information wrong, try to send too much money, or look at the website the wrong way. It tells you nothing. Every time I get the error, I call the number. Every time I call the number, I get a different explanation.

- This is a website problem. Try logging out and logging back in.

- Youíve already sent too much money (I HAVENíT SENT ANY DAMN MONEY, THANKS.)

- You may have entered some details wrong and the total is cumulative so even if it gives you an error, that counts towards the $2k per day you can send (even if it hasnít sent)

- There may be a security hold on your account, let me transfer you.... Weird, thereís no security hold on your account.

Mind you, every time Iíve called this number (16 times so far this month, plus the other various Citi numbers Iíve had to call), you get a phone tree. You would think that itís always the same phone tree. But you would be wrong. Whyís that? Because at some point, the system was sick of seeing my number and automatically sent me to the fraud department every single time I called it.

The fraud department was completely bewildered and couldnít figure out how I was getting them every time I called the general support number.

At some point, that simply resolved itself without explanation.

Tonight, I tried again. Same error. I go through the phone tree, talk to level 1 support, get transferred to a level 2 support, who tells me that the department that can clear the security hold isnít there tonight and Iíll have to call tomorrow. But weíve already determined that I donít have a security hold (on 3 separate occasions).

You may at this point be wondering: Why donít you just hand them cash or a check? Well, we all live a pretty high paced Bay Area lifestyle here. Mobile check deposits are capped for banks and the rents are high here. So depositing the check requires going to an actual bank. Itís a pain for me and itís a pain for my landlord. Cash is also a risky proposition.

So tonight, Iím online looking at banks and credit unions in my area. Preferably ones that have non-useless support and low foreign ATM fees. Anyone have a recommendation?

gettingoldercarguy

> Nick Has an Exocet

gettingoldercarguy

> Nick Has an Exocet

02/28/2018 at 23:03 |

|

USAA = da bomb

Nick Has an Exocet

> gettingoldercarguy

Nick Has an Exocet

> gettingoldercarguy

02/28/2018 at 23:05 |

|

I donít qualify :(

gettingoldercarguy

> Nick Has an Exocet

gettingoldercarguy

> Nick Has an Exocet

02/28/2018 at 23:07 |

|

Balls. †Have you asked your landlord who they use?

npc58501

> Nick Has an Exocet

npc58501

> Nick Has an Exocet

02/28/2018 at 23:42 |

|

Any credit union is better than that fuckin nightmare of a bank.

When I had PNC Bank when I was poor, they threatened to take $25 bucks a month just for a paperless checking/savings account or a certain percentage of my deposits under $2000†as a service fee. Same day I dropped everything closed my account and opened one at a credit union I qualified for. I never looked back and over the last 7 years, I have never found a cross word to say about them so far.

Banks cannot operate and conduct business without your deposits. Treat them like such.

Ash78, voting early and often

> Nick Has an Exocet

Ash78, voting early and often

> Nick Has an Exocet

03/01/2018 at 00:02 |

|

Discover Bank has been awesome to me for a long time, and the card since 1997. Literally not one problem that wasnít immediately resolved by Americans in Utah or Arizona.

If you need physical branches, then credit unions all the way.

This is coming from a guy whose whole career has been in commercial banks.

Nick Has an Exocet

> gettingoldercarguy

Nick Has an Exocet

> gettingoldercarguy

03/01/2018 at 00:15 |

|

Wells Fargo, which is probably the worst bank in the universe.

Akio Ohtori - RIP Oppo

> Nick Has an Exocet

Akio Ohtori - RIP Oppo

> Nick Has an Exocet

03/01/2018 at 08:39 |

|

I use USAA as my primary, Ally as my secondary. Both are straightforward, full featured banks. Allyís cash advance rules are a little arcane, but other than that I havenít run into any problems, plus they have killer interest rates on savings accounts. (I was trying to get cash out to buy a car and they wanted me to do 5x$1000 cash advances rather than 1x$5000. No idea why.)

ITA97, now with more Jag @ opposite-lock.com

> Nick Has an Exocet

ITA97, now with more Jag @ opposite-lock.com

> Nick Has an Exocet

03/01/2018 at 10:33 |

|

I donít know what their coverage is like in the bay area, but Iíve been primarily banking with BBVA Compass for about 10 years now. Theyíve been pretty good to deal with, and issues have been few, far between and easily resolved when they did happen.